The World of Cryptocurrencies – Part 1 – What is Ether

In learning about the cryptographic and technical aspects of cryptocurrencies, we have mainly focused our attention on Bitcoin up to this point. And while Bitcoin is the most prolific cryptocurrency in use today, there are several others which are worth exploring. In this 5-part series we are going to take an individual look at several other “coins” and explore their place in the ecosystem. These include:

- Ether

- Monero

- Ripple

- IOTA

- Cardano

Haven’t heard of some of these before? No problem! We will first focus on presenting a basic overview of each of these coins – what makes them special? How are they used? why not just use Bitcoin instead? are they worth the investment? Then we’ll take a detour and explore each of these coins individually – there’s a lot to learn!

In this first exploration into the world of cryptocurrencies, we’re going to take a look at Ether. And before we can understand exactly what Ether is, we need to understand Ethereum.

What is the Crypto Called Ethereum

According to the Ethereum Foundation’s website, “Ethereum is a global, open-source platform for decentralized applications.”. These “dapps” (decentralized applications) can be used as cryptocurrency wallets, financial applications, games, or even decentralized market. If you can think of an application currently in use, Ethereum can build such an application as well. Dapps are built on “smart contracts” which are simply deterministic scripts of code that will perform the same operation each time they are run, regardless of the person or entity employing the code.

The amazing part of Ethereum is its foundation – a blockchain. All Ethereum assets are written to a blockchain to ensure that they are forever encapsulated and verifiable. What’s more, this blockchain is Turing-complete (which may delight computer science geeks). To keep things simple, this means that a system is computationally universal. Additionally, it can run on any system and complete an operation. (for perspective, Bitcoin is not Turing-complete, so applications cannot be written to its blockchain and executed)

This may sound strange at first – aren’t we supposed to be tackling cryptocurrencies? But fear not, dear reader, we simply needed to lay the groundwork to reach this conclusion – Ether is the cryptocurrency that drives the Ethereum ecosystem (you can now breathe a sigh of relief). In this sense, Ether is very similar to what we have discussed concerning Bitcoin. As a cryptocurrency, Ether can be used to buy goods or services or even receive payment for such items. Payments can be sent to anyone, anywhere quickly and cheaply.

The Difference Between Cryptos

However, there are quite distinct differences between the two cryptocurrencies, both in their designed use cases and implementation. Ether differs from Bitcoin in the fact that it can be used as the native currency within its own ecosystem – Ethereum – while Bitcoin is specifically designed as a decentralized currency without an internal application environment.

There are a variety of dapps that are built natively on Ethereum and use Ether as the means by which to earn payment or buy goods. While Bitcoin is designed to produce a new block every 10 minutes or so, Ethereum produces new blocks every 12-14 seconds, allowing for transactions to take place much more quickly instead of having a transaction stuck in the Bitcoin mempool for extended periods of time. Finally, the majority of mining with Ether is done using GPUs as opposed to specially designed ASICs. This is due to the algorithm in use, Ethash, which doesn’t lend itself to specifically programmed circuitry. (This is done on purpose – check out this link to see why this was originally proposed and implemented).

Ether Basis Monetary Denominations

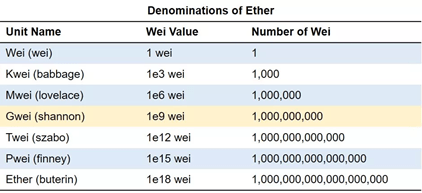

The basis of Ether’s monetary denominations has quite an interesting background. Rather than employing names with prefixes based on the root value (say, for instance, a “centi-Ether” or a “micro-Ether”), each unit of Ether measurement is based on the name of a famous computer scientist or an influential figure in cryptocurrencies (with the Wei as the atomic denomination). You can see the denominations in the table below:

Table 1: Ether’s Interesting Denominations. Table from Investopedia / Carla Tardi.

The actual unit name can be seen on the left (Wei, Kwei,…) and the colloquial name in the Ethereum community is mentioned in parentheses (wei, babbage, …). Notice that 1 Kwei is equal to 1,000 Wei (i.e., a kilo-Wei). The same holds true for all denominations except the Ether (Mwei is mega-Wei, Gwei is giga-Wei, and so on). If you are interested in the names of the individuals mentioned above, a brief explanation can be found here.

Ethereum Gas

While all of these names are valid terms to describe Ether, the Gwei is most often used to denote specific transaction amounts. Why? To answer that, we need to first understand the role of “gas” in Ether transactions. Similar to transaction fees in Bitcoin, the amount of gas (a unit of work in Ethereum) needed for an Ether transaction determines the relative cost of completing the transaction. Because every node requires CPU cycles or network operations to perform a unit of work, gas is used to compensate nodes for their role in completing these tasks.

As tasks become more intensive or require more information to cross the network, the total cost of the operation goes up. If you’re willing to pay more per gas, miners will be more likely to quickly complete your transaction since they will earn a higher fee. In essence, your total fee comes to how much gas is used (how many units of transaction work) multiplied by how much you are willing to pay for gas (cost per unit of work).

Alright, back to Gwei. If you want to determine the cost of gas for a specific transaction, you’ll allot a specific amount of Gwei that you’re willing to pay for it. Notice that Gwei, while being equal to one billion Wei, is still only equal to one-billionth of an Ether (1 Gwei is 0.000000001 ETH). How much does a typical transaction cost? It all depends on the current block gas price limit at the time you attempt a transaction (this site for instance will show you the current block gas limit).

Ethereum Total Supply

How many Ether will ever exist in the Ethereum network? This isn’t a cause for concern like it is in the Bitcoin ecosystem. Bitcoin will only have 21 million BTC ever in existence. This means that when the final BTC is gone there will be no more coins to uncover and transaction fees will become the main viable solution for miners to earn money.

Ethereum, however, doesn’t employ such a mechanism and instead produces more Ether each year. There has been talk of introducing a hard cap on the total number of Ether in existence, but this has yet to come into existence and does not seem to be the inevitable end to the current operation of the network. The current system uses a Proof of Work (PoW) algorithm to ensure that each transaction is correct and added on the blockchain.

Ethereum Proof of Stake

While there have been talks for years concerning a switch to a Proof of Stake (PoS) algorithm, the current implementation designed as a hybrid of the two is named Casper. While older PoS algorithms have been less than effective, Casper is designed to ensure that all participants continue to play nicely and punish those who refuse to follow the rules.

How Old is Ethereum

Although Ethereum is only about 5 years old (beginning July 30, 2015), there has already been a forking of Ethereum. A quick back story: In June 2016, the Decentralized Autonomous Organization (DAO) launched as a venture capital firm using the Ethereum blockchain. Even though it began with $150M USD, it was immediately hacked due to a flaw in the DAO code. The thieves stole around $50M USD worth of Ether. Rather than continuing with the vast sum of stolen ETH, the Ethereum Organization decided to hard fork the Ethereum blockchain at block 192,000.

Due to this action, the previous transactions were invalidated, and Ethereum Classic continued with the original blockchain while Ethereum stuck to the new blockchain. As one can imagine, there is now a rivalry between the two forks, with each attempting to prove its dominance and efficacy in greater proportion to the other.

Learn More About Ethereum

Ether (and by relationship, Ethereum) is a novel and interesting cryptocurrency. While we’ve tried to cover plenty of information here about Ether, there’s still so much more to learn. Take a look at the articles below if you are interested in learning more about Ether:

- Various applications (or dapps) can be written using Ethereum and paid for with Ether.

- Here some “behind-the-scenes” details concerning Ether’s structure and economic basis.

- Curious about Ether’s use in Ethereum? Here is an encyclopedia of information about Ethereum, including videos and diagrams to illustrate concepts.

- Let’s compare Bitcoin and Ethereum to better sort out the differences and key take-aways.

- Finally, what exactly is Ethereum gas and how does it work?

Thanks again for reading! In the next post, we’re going to take a closer look at Monero – see you then!

Trackbacks & Pingbacks

[…] back to our tour of the cryptocurrency landscape. In the last post, we discovered Ether (and by relationship, Ethereum). Ether is the “digital oil” that fuels […]

Comments are closed.